Uplifting) Alright guys, so the Section 609 credit repair loophole is all about unverified accounts on your credit reports. So the letters, e-book that teach you the whole deal. My video series, everything that you need to know about unverified collections, unverified charge offs. Foreclosures, old student loans, repos, all that good stuff. You'll learn it in the e-book and the letters. Now, the process is very simple. You send letters to the credit bureaus to ask for verification for these unverified accounts. They need to be verified 100%, 100%. Not 99%, 100% for the Fair Credit Reporting Act. If they're not 100% accurate and verified through a signed contract with your name on it or other instrument of indebtedness that they can prove and show you. Or if a collector or a creditor can prove and show you or give to the bureau it must be deleted. So if it's not 100% accurate during this verification method it must be deleted. So, they have about 30 days from the date they get it postmarked to them okay? So, they have 30 days to the date that they get it, to postmark your response okay? So you send it out on the 1st, they get it on the 7th they have until the 7th to postmark you a response alright? Now, during that process, you may or may not see anything. Yeah, they're not, they might send you a letter that says oh, we verified it. This is verified, oh it's verified. Oh yeah, it was verified. Well how was it verified? Who verified it? What was this method of verification? That is in the letters and the e-book as well. That's your next round of letters and so on and so forth. Until you get the verification 100% accurate, or it's deleted from your credit report. Now, that's how it worked for me. That's how it works for many people...

Award-winning PDF software

How to prepare 609 Dispute Letters PDF

About 609 Dispute Letters PDF

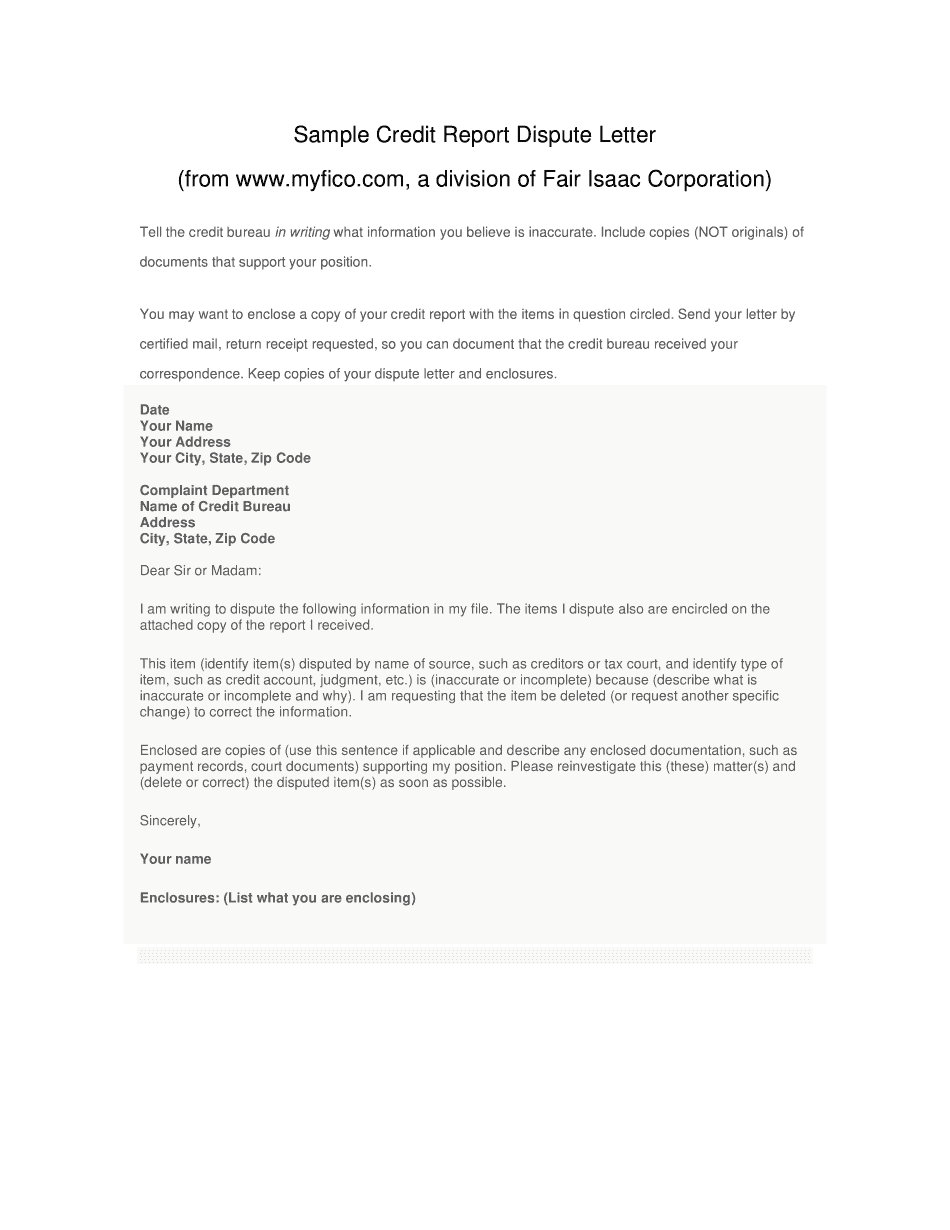

Dispute Letters PDF is a type of document that one can use to dispute errors or inaccuracies present on their credit reports. These letters are sent to credit reporting agencies and are designed to request that the agency investigate and either verify or remove the disputed information from the consumer's credit reports. People who have inaccurate or outdated information on their credit reports can benefit from a 609 Dispute Letters PDF as it is an effective tool to clean up their records and improve their credit score. This can be helpful for individuals who are looking to obtain loans, credit cards, or better interest rates on mortgages or car loans. Furthermore, 609 Dispute Letters PDF can help individuals in situations where they have been victims of identity theft, as disputed errors on credit reports can be caused by identity theft.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 609 Dispute Letters PDF, steer clear of blunders along with furnish it in a timely manner:

How to complete any 609 Dispute Letters PDF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your 609 Dispute Letters PDF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 609 Dispute Letters PDF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 609 Dispute Letters PDF